India has seen significant growth in e-commerce in recent years. The e-commerce market in India was valued at around $38.5 billion in 2017 and is expected to reach $200 billion by 2026, according to a report by the India Brand Equity Foundation. This represents a compound annual growth rate of around 20%.

There are several factors that have contributed to the growth of e-commerce in India. One of the main drivers has been the increasing penetration of internet and smartphone usage in the country. According to the Telecom Regulatory Authority of India, the number of internet users in the country has grown from around 400 million in 2017 to over 600 million in 2021. This has made it easier for consumers to shop online and has led to a rise in the number of e-commerce platforms in the country.

Another factor that has contributed to the growth of e-commerce in India is the increasing use of digital payment methods. The government of India has promoted the use of digital payments through initiatives such as the Unified Payment Interface (UPI) and the BharatQR code, which have made it easier for consumers to make online transactions.

The growth of e-commerce in India has also been supported by the increasing number of small and medium-sized enterprises (SMEs) that are using e-commerce platforms to reach new customers and expand their businesses. The government of India has also supported the growth of e-commerce through initiatives such as the National Policy on Electronics and the Digital India program, which aim to promote the adoption of digital technologies and e-commerce in the country.

Overall, the e-commerce market in India is expected to continue to grow at a rapid pace in the coming years, driven by factors such as the increasing penetration of internet and smartphone usage, the adoption of digital payment methods, and the support of government initiatives.

E-Commerce or Electronic commerce as we all know is nothing but a medium by which buying and selling of goods is done via the use of Internet. Based on the participants involved in the network, E-commerce can be classified as:

- C2C (Consumer to Consumer):This kind of transaction takes place via online classified Ads or auctions or by selling personal services online.

Ex: ebay.com auctions

- B2B(Business to Business): This takes place when a company wants to conduct a commercial activity with another business firm online. This is done when companies have all their operations computerized and now they want to go to a higher stage by linking their customers and vendors. This is done by the use of supply chain software linked to the ERP application.

Ex: Altra, FreeMarkets

- B2C (Business to Consumer):This is the most common form of E-Commerce in which a variety of goods ranging from apparels, footwear, stationery, gifts, and services like travel booking, online matrimonial and digital downloads are available. This mode provide the consumer with services like information gathering, comparing and buying or selling goods online.

Ex: shaadi.com, makemytrip.com, shopclues.com, flipkart.com

- Consumer-to-business (C2B) e-commerce: This type of e-commerce involves the sale of goods and services by consumers to businesses. An example of C2B e-commerce in India is a consumer selling handmade crafts to a business through an online platform.

- Social media e-commerce: This type of e-commerce involves the use of social media platforms such as Facebook and Instagram to sell goods and services to consumers.

- Mobile e-commerce: This type of e-commerce involves the use of mobile apps to purchase goods and services. Many e-commerce platforms in India have their own mobile apps, which make it easier for consumers to shop on the go.

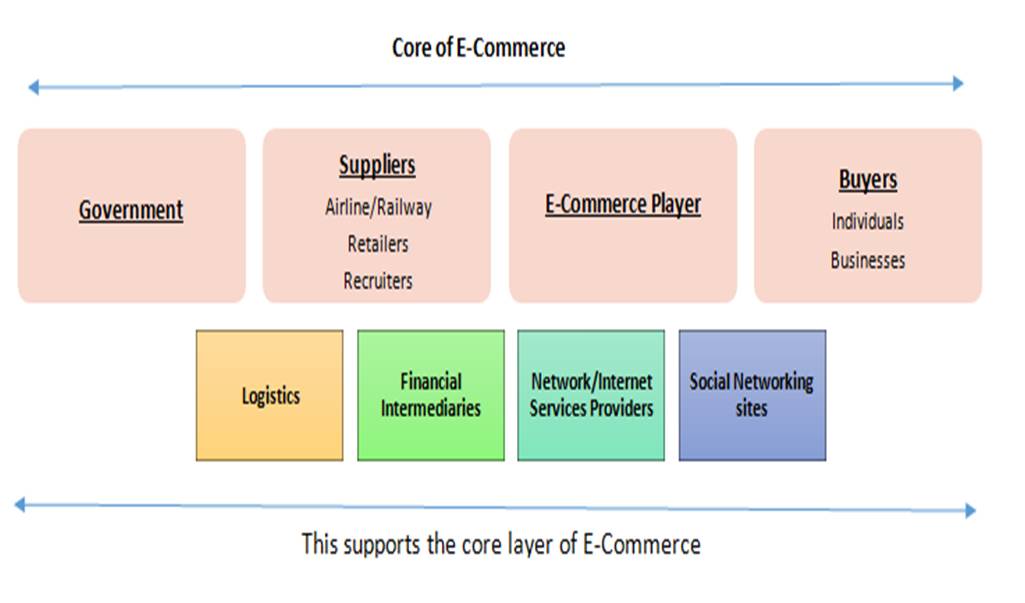

Components of E-Commerce:

Following stakeholders are a part of E-Commerce sector:

There are basically 3 transactions that take place in an E-Commerce system:

Product flow: Movement of goods from suppliers to end consumers through E-Commerce and logistics players

Information flow: Information transmission of orders from customers and subsequent information flow of order status through the value chain

Monetary flow: It involves payments from consumers to e-Commerce players and suppliers and vice-versa through financial intermediaries

The Growth Story of E-Commerce in India

Started in India in the year with the introduction of B2B portals in 1996, now E-Commerce is all set to become one of the successful medium for business transactions.

Between 2000 and 2005:

The first wave of E-Commerce in India was characterized bya small online shopping user base, low internet penetration, slow internet speed, low consumer acceptance of online shopping and inadequate logistics infrastructure. Thereafter, the IT downturn in 2000 led to the collapse of more than 1,000 E-Commerce businesses in India. Following this, there was muted activity in the space in India between 2000 and 2005.

Between 2005 and 2010:

There were basically two major transitions that took place that aided in the build of E-Commerce story in India. They were:

- Online Travel:The entry of Low Cost Carriers (LCCs) in the Indian aviation sector in 2005 marked the beginning of the second wave of e-Commerce in India. The decision of LCCs to sell their tickets online and through third parties enabled the development of Online Travel Agents (OTAs). They developed their own websites and partnered with OTAs to distribute their tickets online. The Indian Railways had already implemented the e-ticket booking initiative by the time LCCs started their online ticket booking schemes.

- Online Retail: The growth of online retail was partly driven by changing urban consumer lifestyle and the need for convenience of shopping at home. This segment developed in the second wave in 2007 with the launch of multiple online retail websites. New businesses were driven by entrepreneurs who looked to differentiate themselves by enhancing customer experience and establishing a strong market presence.

Between 2010 – 2015:

Group buying: Starting in 2010, the group buying and daily deals models became a sought after space for entrepreneurs in India, emulating the global trend. Group-buying sites have seen a significant rise in the number of unique visitors and membership.

Social Commerce: It is a key avenue for E-Commerce players to reach out to target customers. Companies have started establishing their presence in the social media space for branding activities, connecting with customers for feedback and advertising new product launches.

India’s E-Commerce market grew at a staggering 88% in 2013 to $16 billion, riding on booming online retail trends and defying slower economic growth and spiraling inflation, according to a survey by industry body ASSCHOM.

India’s E-Commerce market was about $2.5 billion in 2009, it went up to $6.3 billion in 2011 and to $16 billion in 2013.

E-Commerce Driving Factors: E-Commerce has led to:

- Reduced search and transaction cost

- Reduced process lead-time and faster time to market

- Increased customer service

- Improved convenience and shopping experience

- Increased information transparency

- Knowledge generation

- Novel products and services

From 2015 to 2022:

The e-commerce market in India has seen significant growth over the past few years, from 2015 to 2022. According to a report by the India Brand Equity Foundation, the e-commerce market in India was valued at around $16.4 billion in 2015 and is expected to reach $200 billion by 2026, with a compound annual growth rate of around 20%.

There are several factors that have contributed to the growth of e-commerce in India over the past few years. One of the main drivers has been the increasing penetration of internet and smartphone usage in the country. According to the Telecom Regulatory Authority of India, the number of internet users in the country has grown from around 300 million in 2015 to over 600 million in 2021. This has made it easier for consumers to shop online and has led to a rise in the number of e-commerce platforms in the country.

Another factor that has contributed to the growth of e-commerce in India is the increasing use of digital payment methods. The government of India has promoted the use of digital payments through initiatives such as the Unified Payment Interface (UPI) and the BharatQR code, which have made it easier for consumers to make online transactions.

The growth of e-commerce in India has also been supported by the increasing number of small and medium-sized enterprises (SMEs) that are using e-commerce platforms to reach new customers and expand their businesses. The government of India has also supported the growth of e-commerce through initiatives such as the National Policy on Electronics and the Digital India program, which aim to promote the adoption of digital technologies and e-commerce in the country.

Overall, the e-commerce market in India has experienced significant growth over the past few years and is expected to continue to grow at a rapid pace in the coming years.

The Way Ahead

The supporting ecosystem for E-Commerce has evolved significantly from what it was a decade ago. Internet is the key to the development of E-Commerce and has become prevalent in daily life. People depend on heavily on internet for activities ranging from accessing email and searching for information.

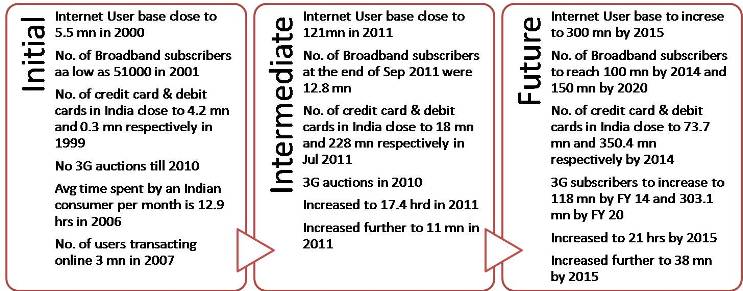

The figure above describes the initial, intermediate & predicted stages of E-Commerce in India.

Upcoming Trend

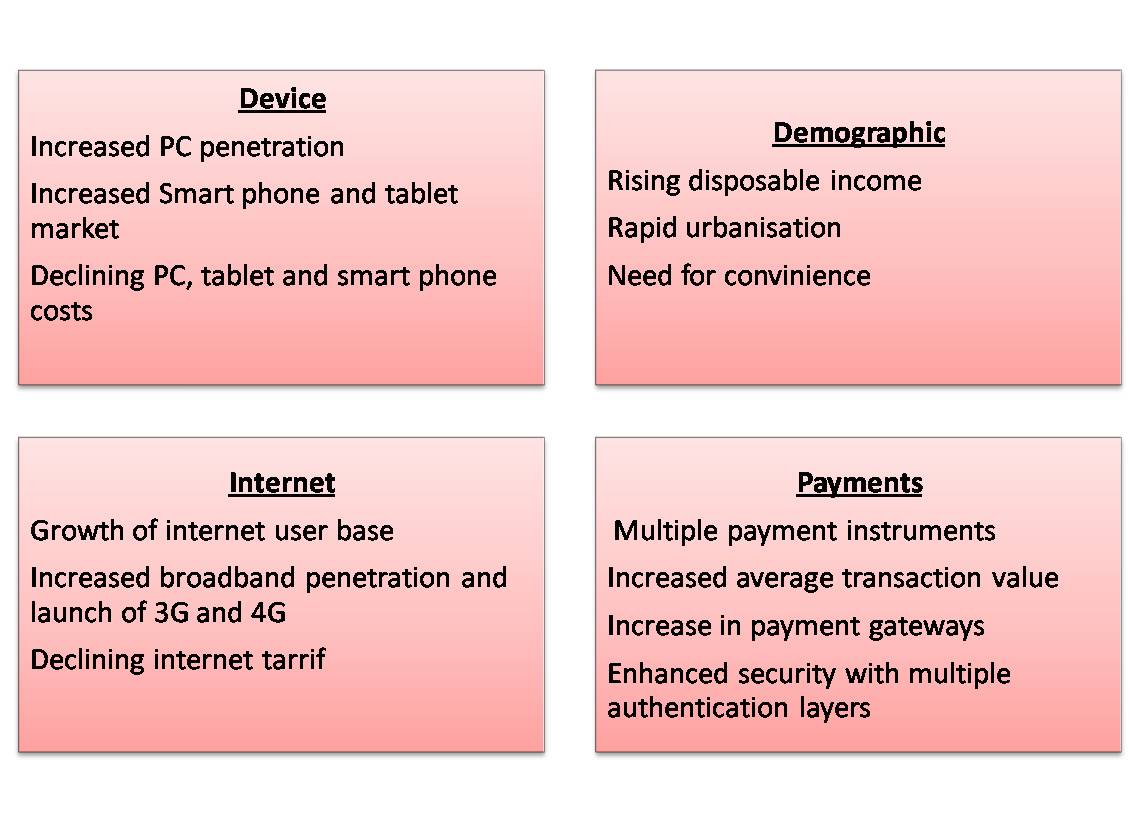

Internet Penetration: With an exponential increase in internetusage, there’s an increasing PC and broadband penetration, coupledwith the declining prices of PCs. Tablets and smartphones have given a new meaning toconnectivity and user experience. The adoption of 3G and upcoming 4G technology, alongwith the declining prices ofsmartphones, is expected to result in an additional increase in internet usage in the country.Improvements on the payment front have brought about the increasing use of plastic moneyby Indian consumers. Payment gateways have now been made more secure through multiplelevels of authentication via one-time passwords (OTPs). This hashelped strengthen users’ confidence in carrying out online transactions.

M-Commerce: India has more than900 million mobile users, of which around 300 million use data services. Thisis expected to grow 1200 million by 2015. Also, more than 100 millionmobile users are expected to use 3G and 4G connectivity in the coming few years. Of the total 90 million mobile users, only 27 million are active on theInternet. Moreover, only 4 per cent of the active mobile internet users buyproducts through mobiles. However, mobile shopping is on upward trend and isexpected to increase five–fold to 20 percent in the medium term.

FDI in E-Commerce sector: Presently the Indian Government has allowed 100 per cent FDI in B2B e-commerce, while business-to-consumer (B2C) is prohibited. In addition to that there’s a compulsory 30 percent local sourcing norms for foreign players.

Companies like Amazon, eBay, and Tesco are coaxing and holding meetings with the DIPP to invest in an emerging market India. They have even been investing some of the local start-ups here like Amazon entered India via Junglee.com.

The news that Department of Industrial Policy and Promotion (DIPP) has started consultations with stakeholders on allowing foreign direct investment in retail e-commerce before the end of this financial year, has nonetheless raised our expectations of expansion of Indian E-Commerce industry.

Summarization of factors determining future of E-Commerce in India

Conclusion

Undoubtedly, it’s an expansion time for E-Commerce Industry. E-Commerce players are banking on the Indian internet growth story. The fact that an average online user is spending more time online gives these players the opportunity to draw more users to their websites through innovative marketing strategies such as those revolving around social media.

Furthermore, to fully utilize the opportunity, players need to leverage the growing number of mobile devices in the country. They should focus on developing mobile-compatible websites and applications. This would allow customers to log on to easy-to-access platforms and browse e-Commerce websites on their mobile devices.

They also need to focus on innovation to tackle challenges arising from low credit and debit card penetration. They could consider working with financial intermediaries to develop payment systems, such as escrow services, for resolving issues around security and product delivery. The RBI could step in and reduce the number of online transaction failures by defining service metric quality and monitoring it at regular intervals. This would enable it keep a close eye on the performance of financial intermediaries and plug gaps as soon as they occur.

Heena Motwani

IIM Shillong

(The article is the illustration of author’s opinion. There can be different and even completely contrasting viewpoints.

References:

- http://articles.economictimes.indiatimes.com/2013-11-24/news/44412771_1_e-commerce-space-marketplace-model-cent-fdi

- http://www.business-standard.com/article/economy-policy/government-plans-to-allow-fdi-in-e-commerce-before-april-113123000754_1.html

- E & Y Report on E-Commerce

- IBEF Report on E-Commerce

- ASSOCHAM Report on E- Commerce